Discussion Paper: Transforming Financial Transactions through Technology

Discussion paper on the analysis of using a pay everyone at once model and the impacts this can have across accounting, regulations, banking and business costs.

Abstract

This document explores the paradigm shift in financial transactions, focusing on the hidden costs of invisible banking, the transformative potential of split payments, and the resultant changes in the risk profile of businesses. Through a top-level analysis, this paper aims to provide insights into how modern financial technologies, including blockchain and API-driven payment solutions, can reshape the landscape of business transactions.

Executive Summary

The evolution of blockchain financial transactions in the digital age has highlighted the inefficiencies of traditional payment, accounting, and banking systems. Innovative payment solutions, especially split payments facilitated by digital platforms, can transform the flow of money and the banking concept. The "Distributed Ledger" concept being introduced to link disparate private ledgers of businesses, is allowing for the seamless and safe movement of funds by established business rules and protocols. This system enhances transparency and efficiency, ensuring all parties receive their due share without delay using an end-to-end process. The advent of this blockchain technology and smart contracts promises to revolutionize fund management and transfer, reducing costs, increasing speed, and eliminating many current system inefficiencies that impact how we do business.

The Core Premise

Businesses dread the "paperwork" born in 1494 to curb errors and fraud. Yet, this ancient system forces them to act as intermediaries for customers and suppliers, bringing added costs, risks, and inefficiencies and becoming an invisible clearing bank. We've merely polished the double-entry process for six centuries without questioning its necessity. We are looking at transforming financial transactions with real-time, atomic transactions in a trustless setting called the "Distributed Ledger ."This innovation ensures transparency for everyone, creating a shared ledger that surpasses the old double-entry limits.

Upon execution of a transaction, the involved funds are immediately divided and disbursed. This division is governed by predefined rules that dictate the proportion of funds each party receives. This automated process ensures that all parties involved receive their share without delay, optimizing the efficiency and transparency of financial transactions.

The core work for this was created in 2022 with an initial blog published September 2022 - Split payments changes the risk profile of a business

Background

This section gives context to how a change to real-time business rule-driven programmatic payments can have an impact.

History

The process of transferring funds between different entities is rooted in the invention of the double-entry bookkeeping system, first documented in 1494. This system pioneered the concept of recording transactions with two entries on a ledger that always has to balance.

Over the centuries, technological advancements have extensively automated this process. The evolution began with simple adding machines and has progressed to encompass sophisticated computers. This technological trajectory has given birth to comprehensive accounting systems such as Xero, Quickbooks, and SAP. These platforms manage ledgers across extensive business operations, streamlining financial management at all levels.

In addition to automating individual ledgers, systems have also been developed to facilitate connections between different ledgers. This critical development enables the efficient movement of funds between various entities. Banks often act as intermediaries in this process, bridging the gap between disparate ledgers.

The history of banking has been closely intertwined with the advent of double-entry accounting. This accounting system, which is marked by every entry to an account requiring a corresponding and opposite entry to a different account, has played a significant role in the development of banking over the centuries. The emergence of this system has dramatically improved the efficiency and effectiveness of banking operations, providing a clear and accurate record of financial transactions. Consequently, it has fostered the growth and evolution of the banking industry, shaping it into the complex and sophisticated system we know today.

Banks have existed since at least the 14th century. They provide a safe place for consumers and business owners to stow their cash and a source of loans for personal purchases and business ventures. In turn, the banks use the cash that is deposited to make loans and collect interest on them. The basic business plan hasn't changed much since the Medici family started dabbling in banking during the Renaissance. (Investopedia)

The growth and evolution of fund transfer methods have been remarkable. They started with physically sending individuals the funds, transitioned to the use of paper, telegraph, and then fax machines, and have now culminated in direct computer-to-computer communications. Services such as Swift and other banking networks have enabled these modern, digital transactions.

Alongside these significant developments, standards have been created. These standards are pivotal in ensuring seamless information interchange between systems and preventing misunderstandings that could lead to costly errors and potential loss of funds. To complement these standards, regulations, and policing mechanisms have also been established to address criminal activities and negligence within the system.

However, every addition and advancement in this intricate process has increased the overall cost incrementally. The system's highly complex nature introduces multiple potential points of failure. These include errors, opportunities for criminal activities, and a significant time investment required for processing transactions.

Due to the inherent complexity and slow speed of the system, every link in the chain must technically function as a bank. Every participant must abide by the relevant rules and regulations as funds pass through their hands. This has created the invisible bank of businesses, where they hold funds or give unsecured loans as the funds are held in their systems before moving on through the chain. (The invisible banks costing us 10% )

Moreover, the complications and costs associated with this system have a profound impact on economies at a global level. The inefficiencies within the system and the related costs contribute to the global economic burden, significantly affecting the world's Gross Domestic Product (GDP).

Another consequence of slow banking processes is the creation of new products, which disrupt business operations. Subscription models have emerged, where customers pay for services over time to reduce costs and performance burdens associated with real-time transactions. The downside is that you might spend ten times more for a service than the following users because they use the system more frequently. ( The subscription model penalizes us )

While these systems have served us well for a long time, the digital age presents new challenges and opportunities. Innovations such as blockchain technology and smart contracts promise to revolutionize how we manage and transfer funds - reducing the cost, increasing the speed, and eliminating many inefficiencies in our current system.

Digital Systems

With its trust-less model, Bitcoin started addressing issues in traditional money transfer systems despite being a one-to-one model with high fixed costs and lengthy processing time. However, it still held to the 1494 principle of double-entry accounting. The cost now corresponds to the transaction data rather than its value, creating a fixed-cost model for money transfers.

Bitcoin's premise was "a system for electronic transactions without relying on trust."

Ethereum addressed another part of the issue by allowing programmable payments through smart contracts. The smart contract model can create a one-to-many transfer but isn't a true atomic transfer, as each activity is still a one-to-one transfer. However, this still has cost and speed limitations, and it was complex to set up dynamically. However, it did allow for the removal of accountants, auditors, and lawyers from the money transfer system, reducing additional costs.

As with all new technologies, rapid growth occurs in the early stages, as seen currently. We're moving faster in a more connected world than when the Internet and its underlying protocols were first developed.

New chains and upgrades with low costs are being developed. They process transactions in under two seconds, can handle 10k transactions per second (tps), and speed up new atomic models and more to meet future needs as we make the process faster.

The impact of new communication models has been historically significant. The telecom sector offers a cautionary tale:

The telecom sector offers a cautionary tale: When Voice-Over-Internet-Protocol (VOIP) was invented in 1995, most people disparaged it as a technology that couldn't scale and wasn't a threat to the telecom giants. Then, circa 2003, the technology to scale VOIP arrived – broadband – and within a flash, most of the telecom industry's copper-wire networks became obsolete. useless relics - https://www.forbes.com/sites/caitlinlong/2022/09/23/banks-are-about-to-face-the-same-tsunami-that-hit-telecom-twenty-years-ago/?sh=7949f9827a7a

Finally, this new communication foundation for value transfers and potential connections creates a novel way to interact. However, to move forward, we must reflect on how game-changing global innovations have emerged and what has become irrelevant.

The Go Forward

The challenge lies in the fact that recent digital changes have occurred within a few years, a pace far faster than the development of legal and regulatory frameworks. The more significant impact is that this has happened globally, bypassing countries' borders. It has also been accelerated by the rise of global big tech companies focusing on their stakeholders, not the constituents of where they operate. This has become very centralized and in the hands of the few.

The novelty of the blockchain model may not align with these existing systems as it is focused on being decentralized. Still, ensuring its integration doesn't damage these systems or invite undue risks that affect the centralized model is also crucial.

A critical aspect in this new era is the financial transactions involving the transfer of value, with a particular emphasis on monetary transfers that can be local or global easily. This is not merely about shifting from one party to another but involves a more complex, nuanced process.

The real work is bridging the gap between decentralized and centralized economies, creating a symbiosis that allows them to work in concert. This is vital because, in the real world, we often find ourselves interfacing with both types of economies.

One potential advantage of the blockchain trust-less execution model is the ability to execute payment contracts at the very moment consumption happens. This introduces a level of immediacy and efficiency that traditional models struggle to match. It's a radical shift from the old ways, where payment processing and consumption were disjointed events that could be managed separately. Now, they co-occur, which can enhance transactional efficiency and user experience.

Furthermore, this model opens the door to implementing a revolutionary vision in payment processing. Imagine a scenario where your funds are instantly distributed to all parties involved as an atomic transaction when you pay for a product or service. This is made possible by a smart contract, a self-executing contract with the terms of the agreement directly written into code. This contract operates without human intervention, removing the need for a middleman or any potential payment delays. It's a new world of financial transactions where trust is built into the system, and the flow of value is seamless and efficient.

An impact seen with this is the alteration in the revenue stream of a business. This is not just any revenue; it becomes the genuine revenue of the business. This type of revenue plays a significant role in a business's financial dynamics as it directly affects various costs. These costs are intricately linked to a business's revenue, which changes this. This means that any change in the revenue will inevitably result in subsequent adjustments in the related costs, thereby impacting the business's overall financial health and profitability by simplifying the business and not needing to manage activities for other providers.

Long Term Impact

When a payment can be assured to occur as a standard part of conducting business, it opens up many new possibilities and opportunities. This assurance of payment, or the 'trust of payment' as we refer to it, acts as a foundation that enables a wide range of innovative financial strategies to unfold.

One opportunity that comes to the forefront is the potential for financing an activity, secure in the knowledge that rules can be applied to ensure the return of those funds. This eliminates the need for intermediaries, preventing any interruption or delay in the flow of funds. This principle is the bedrock upon which the Decentralised Finance (DeFi) world has been built. However, applying this principle does not have to be constrained to the virtual domain. It is now being expanded and adapted to suit real-world activities.

A key area where this principle finds applicability is tokenizing real-world assets with attached yields. For instance, consider real estate. Here, the yield could be linked directly to the tenant's activity rather than being subject to the tenant's whims and fancies about when to pay. This ensures a steady, predictable flow of revenue for the property owner, significantly reducing the risk and uncertainty associated with rental income.

This trust-based model could also be applied where a creator has sold some of the rights to their work and is paid as and when their work is consumed. This monetization method provides a steady income stream for creators while ensuring that they retain control and ownership over their work. An example of this could be a Yoga teacher who creates instructional videos. We started with this premise when we tried to monetize Yoga teacher videos, estimating they would be worth $20k over four years. The revenue generated from these videos could be tokenized, effectively converting it into an asset against which the teacher could borrow.

The key to unlocking these possibilities is the 'trust of payment.' Once established, this trust can lead to a multitude of innovative financial solutions, enabling businesses and individuals to harness the full potential of their assets and activities.

Economics

The section looks at the economic impact this can have in changing the process of moving value.

There are a number of layers to this, from the banking network, which now interfaces with consumers and businesses, through the merchant model and the people who manage this activity.

Consumer/Merchant relationship

The consumer/merchant interaction model has a significant impact, particularly regarding the costs it incurs.

In the current digital model, a fee is collected whenever a consumer purchases. This contrasts with the historical cash model, where no such fee existed. However, merchants bore the costs of managing cash, from tracking and managing cash floats (acting like mini banks) to counting and depositing cash into the bank. The digital model has replaced these tasks with a percentage fee model.

This fee model has led to the creation of a new middleman beyond banks. Payment providers like Visa and Mastercard act as aggregators for a fee, and loyalty programs also become part of this system.

This has impacted the costs of this relationship between the consumer and merchant, with these funds being taken out of the consumer economy, affecting the GDP.

💰 In 2022, Americans paid $163 billion in fees and interest on credit cards

In 2022, consumer spending in the US amounted to $15 trillion, with 17% paid in cash. Consequently, $12.5 trillion was spent using credit cards or similar methods. The payment cost for these transactions represented 1.35% of the total amount, highlighting the considerable influence of these fees on business expenses.

How Much Americans Pay in Credit Card Interest and Fees (2024)

These merchant fees exist worldwide for all digital systems in which someone is paying the costs, whether they are using a credit card, QR code, or just their phone.

The Cost of Card Payments for Merchants | Bulletin – March 2020

This is due to the model of how money has to move across the different bridges of relationships, which has evolved over the years to include many players who all take a cut of the transactions.

This diagram shows the model of how a payment is made with a credit card and the activity that takes place. This doesn't show the impact when loyalty style schemes are added to this process as well.

The blockchain fee model disrupts this as it is a fixed cost or based upon the volume of data, not the value of the transaction, which it may not even know.

The banking system is now under threat due to the emergence of new models and government mandates for real-time transactions. Although this has been slow in the last few years, it is now starting to roll out under the applied pressure.

Similarly, the advent of blockchain and the crypto space has led to the creation of Stablecoin models. These models are proliferating and are eating into banking and credit card revenue models, especially in international remittance.

Open Banking

With the recent advent of Open Banking, this is starting to encroach on the credit card model by allowing direct bank-to-bank transfers, which have minimal or zero fees for the activity and are completed in 1-2 seconds, not the normal 3 business day settlement of the credit card model.

For local transfers, this is now allowing new payment providers and ones that were part of the payment network to come into play. In Australia, the EFTPOS network operates independently of the credit card system, which is owned by the banks and is much cheaper to run to access the terminal network and use their own rail instead of being forced through the credit card rail, which adds extra cost.

What is happening now is that the eftPOS network is moving to a QR code model linked to your bank App. This allows them to bypass the credit card network completely and now allows direct account-to-account transfers.

This creates a closed network loop that changes the economics of moving money. Providers like Block are also implementing this —the transactions stay within their network, cutting out the Visa/Mastercard duopoly model. However, they are still keeping the fees the same, changing their profit levels on transactions.

Visa/Mastercard are fighting back by working with Stablecoin providers and offering their model to them.

However, they all have one fundamental problem: They take a percentage of the transaction, even if that is coming down. At the same time, the volume through the digital models is going up, and the cost of moving data is also coming down.

Other Cost Factors

Fraud and criminals

Due to the nature of digital activities and insufficient ID management, we've opened ourselves up to potential fraud and criminal activities.

This issue arises from the core concept behind cash being anonymous. Originally, cash ownership was determined by physical possession and facilitated through face-to-face transactions. However, in the digital space where transactions occur without visual connection, confirming the identity of the parties becomes more important. Unfortunately, existing digital ID models have been inadequate, paving the way for fraud and criminal activities to scale with the Internet rather than being confined to local areas.

As a result, we all bear the cost of these malicious actors. For example, credit card companies have an insurance scheme that allows them to charge additional fees by having different interest rates to cover this, so they have no true incentive to fix this except the pressure of regulators and governments.

We are now entering an era where IDs can be more secure and linked to our identities, rather than what we know, which has been compromised through various models. Yet, we also want to maintain our privacy, which contradicts this requirement.

The right to privacy is strongly protected in countries like the US and European markets, necessitating better management of this issue.

Regulations

Regulations have been implemented to manage the methods of extracting and handling money.

The introduction of double-entry accounting, which creates separate entries to audit transactions, was the first step in this regulation.

Governments enforce these rules to protect their citizens from unfair practices that could violate their rights and potentially destabilize the government.

Over time, these regulations have evolved to include policing models and the rule of law where applicable. They facilitate global interaction and build trust among all parties.

However, these regulations come with a cost, which is integrated into the banking system through various models. Currently, the fields of Know Your Customer (KYC), Anti-Money Laundering (AML), and terrorism rules are being refined to better monitor these activities. If a bank or company violates these rules, the fines can be substantial, even reaching billions of dollars, to discourage this, but it seems, in many cases, to be just a business expense for the banks.

The current estimated annual cost for the US banking system is $270 billion and growing. There is a lot more that could be discussed on this subject in the future, but it is beyond the scope of this document.

Accounting and supporting services

Every business has compliance costs, which an accountant or an auditor usually handles. Their fees are typically tied to the business's turnover, reflecting the complexity and risk levels they need to address.

This fee is typically 4% of the turnover for a service company. If you're a product company, it's 4% of your gross profit. The accountant's role is to audit the books, verify all data, and handle compliance tasks such as managing the company's taxes and other compliance costs. Accountants are trusted partners that meet the requirements of both the business and government/regulators.

Bookkeeping and clerical fees are also charged for managing the business's paperwork. Depending on the complexity of the business, these costs can range from 5% to 20% of its revenue.

Another consequence of this is a decrease in the complexity of the work. This reduction impacts the risk of errors and the level of skills required to perform the tasks. A simplified work process typically equates to fewer mistakes, leading to an overall increase in efficiency and accuracy. However, quantifying the number of transaction errors is a challenging task. These figures are generally kept internal within businesses and are not readily available for public scrutiny or comparison. Yet, it is safe to assume that a more straightforward process would logically result in fewer errors, further driving efficiency and effectiveness in the financial transaction process.

Summary

When you consider all this, a business spends a significant amount of money and time just managing finances. This can range from 5% to 20%, depending on the size and complexity of the business. All of us indirectly bear these costs, as they contribute to the price of a product.

Fundamental Change

The foundation of our approach is a concept that automatically passes a transaction's value to all parties involved. Rather than having the value centralized and then distributed, this concept ensures that the value is disseminated instantaneously and directly to all stakeholders.

We have christened this innovative concept a "Distribution Ledger ."This term represents a ledger system that acts as a junction, linking the disparate private ledgers of businesses. Instead of each business maintaining an isolated ledger, the Distribution Ledger enables an integrated approach. It allows for the seamless and safe movement of funds according to established business rules and protocols.

The Distribution Ledger is a transformative tool in the financial landscape. It ensures that all parties receive their due share without delay and enhances transparency and efficiency in the process that can continue through the chain to completion.

Attached is a smart contract model that can apply defined business rules to be linked to a transaction with the rules of splitting to be applied to the transaction that is public to the parties involved.

This fundamental change is already being worked on within the Bank of International Settlements, which is calling it a Unified Ledger. It applies this model at the central and regional bank levels, i.e., at the top level, and was presented in November 2023.

BIS. Blueprint for the future monetary system: improving the old, enabling the new

BIS is owned by 63 central banks, representing countries from around the world that together account for about 95% of world GDP

The core of the process will apply encryption rules to the value, which can only be seen by the parties involved or other involved parties like regulators. This allows for reviewing how the funds were calculated to verify against the business rules.

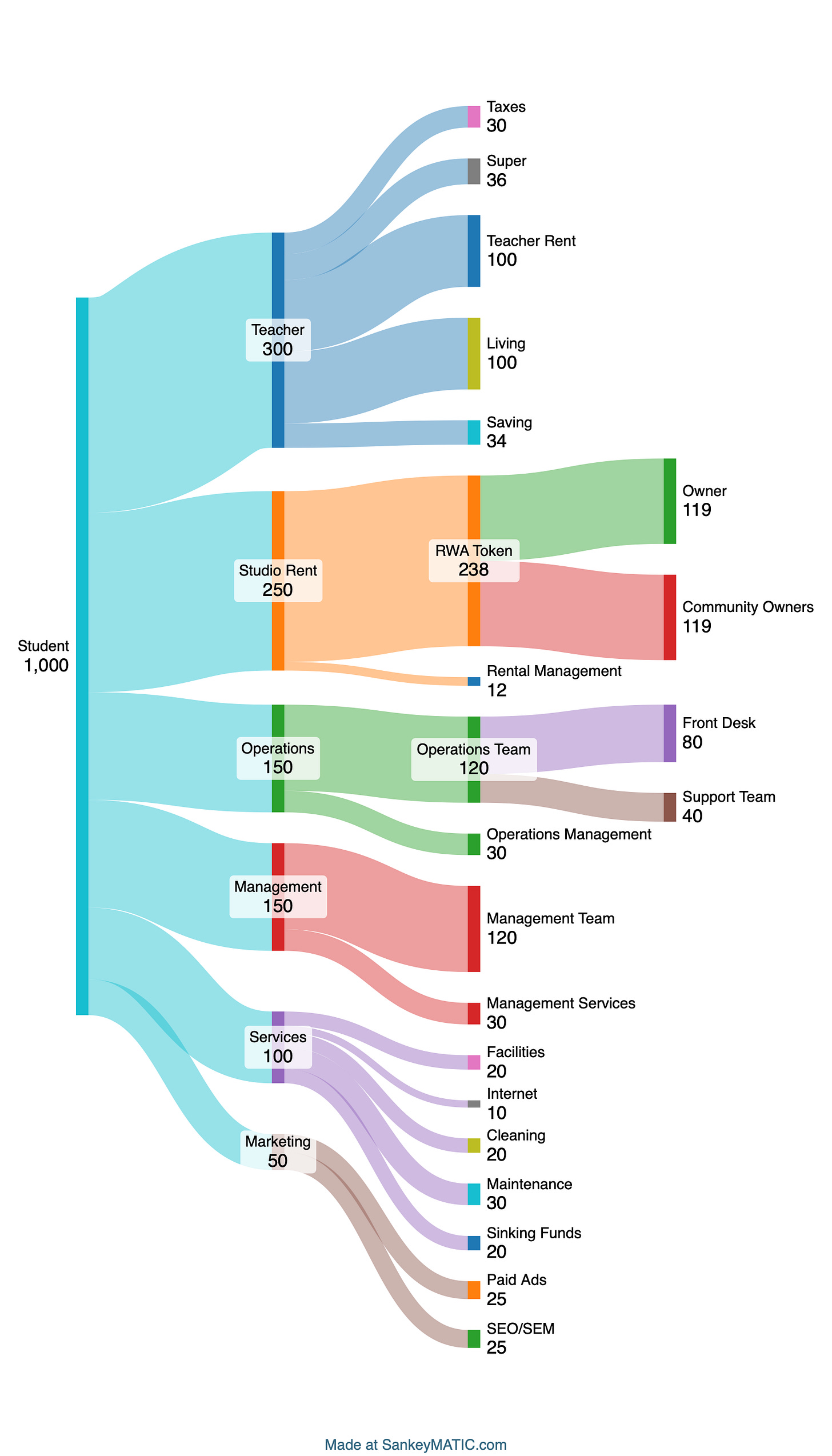

Below is a diagram showing the concept in action using a Yoga Studio example.

The impact of this change is multifaceted. It allows for a trust-less end-to-end transfer, eliminating potential avenues for criminal activities and man-in-the-middle attacks.

Verification also becomes simpler as it is only required from the source, eliminating the need for multiple checks at different layers. This streamlines the KYC/AML and other compliance processes.

Through tools like AI analysis, regulation and compliance can be automatically incorporated into the process. This significantly reduces the cost and misinterpretation of rules, thereby alleviating the legal system's burden.

The accountant's role shifts towards auditing the process, obviating the need for constant verification. The bookkeeper, who often handles the money, has a reduced role and can focus on managing other business variables.

Case Study

Yoga Studio

A yoga studio is made up of students who attend classes and the teachers who teach them. It is managed by the studio owner, who manages all the funds.

The current setup is a student buying a weekly pass to attend classes or paying to access the class there and then. The teachers are normally paid on a 2-weekly basis, meaning that the teacher gets paid between 1 and 3 weeks after the student has done the class.

The business also makes payments to staff and other providers on an agreed basis or per their invoice due date.

The cost of running a studio returns between 3% and 7% net profit, currently leaving very little for debt payments.

Current Company Costs

When this is applied to the BodyMind Life group, which has a $4M turnover across three studios covering a regional location of Byron Bay and the Metro city of Bondi and Surry Hills.

New Model Savings

Payments are made directly to the teachers and landlord from their digital wallet, making up 50% of the income needed to create a true income model for the business.

Implications

New opportunities are possible when you have a trusted payment function linked to an independent action.

The first opportunity can be linked to a Real World Asset (RWA) token with a yield related to the payment function. This allows the payment of the yield to be trusted, creating a new risk profile for the RWA.

This innovative approach can be strategically applied to the Yoga Studio by implementing a shared community ownership model of the property. In this model, a property developer could own a significant 50% stake, gaining first rights to the property's monthly rent yield. This well-considered arrangement dramatically minimizes the risk of losing yield. It provides them a stable platform to meet their commitments, which are likely funded through a reliable, fixed-yield investor trust/fund model.

Conversely, the remaining 50% is intrinsically tied to the revenue, which is dutifully paid to the community owners. This unique setup not only facilitates the community owners' participation in the community's success but also provides them with a variable yield. This aligns seamlessly with the Kula model of fostering community, the new business trend, making it a win-win situation for all parties involved.

Importantly, as the payment is directly linked to the arrival at a class, this eliminates the need for auditing, the involvement of middlemen, or the risk of non-payment. This makes the entire process more efficient, transparent, and mutually beneficial for all stakeholders.

RWA is a growth area that can cover many areas and be applied to many different applications.

Another area of interest is Non-Fungible Tokens (NFTs). These are unique digital assets that have additional features attached to them, such as a payment contract. This payment contract is activated when the NFT is consumed. For example, consider an NFT that is linked to a streaming video. When the user decides to watch the video, the linked NFT is consumed, and the payment contract is triggered. This creates a secure and efficient way of handling digital transactions, and it's one of the many ways NFTs are transforming the digital world.

In the gig market, service providers can now be paid directly by the client upon completion of the service, eliminating the need for a third-party intermediary and its associated risks. An example of this is an Uber driver. As the passenger steps out of the car, payment is made. This payment covers the driver's earnings, car finance, insurance, fuel, maintenance, and a portion to Uber for creating the marketplace and supplying the app to facilitate the transaction.

Let's consider a brick-and-mortar scenario, such as a café transaction involving the sale of a cup of coffee and a muffin. The customer initiates the payment process by scanning a QR code or tapping the Near Field Communication (NFC) pad at the point of sale. The encoded information in the QR code or NFC contains the specifics of the sale, including the total cost and how the funds will be distributed amongst all parties involved in the transaction.

Upon payment confirmation, the funds are immediately transferred from the customer's digital wallet. The distribution is not made to a single entity but is instead divided and sent directly to all parties involved in the transaction. This list of recipients can include the server who took the order, the supplier who provided the coffee beans, the financier responsible for the coffee machine, the supplier of the muffin, the landlord of the property, the operational team that keeps the café running, and management. The remaining funds, which constitute the profit, are then sent to the café's owner.

From the customer's perspective, the transaction is straightforward and seamless. They see the contract ID for the transaction on their receipt, not the complex distribution process behind the scenes. However, if they request a detailed receipt, they can access an overview of the rules applied to distribute the funds.

This innovative transaction approach drastically simplifies the payment process and ensures an efficient distribution of funds. The customer only needs to confirm one payment, and the funds are automatically divided according to pre-established rules and sent to all relevant parties. This streamlines the process, enhances transparency, and ensures all parties receive their due share promptly.

Another important aspect to consider is the role of consignment stock. In this business model, payment to all parties involved is triggered by the sale of the stock displayed on the shop floor. Currently, this process depends on the shop taking stock and then paying the supplier, which could take time.

However, with this system, the stock owner is notified upon sale, and payment is initiated immediately. This payment includes the store owner's share, which could be proportionate to the display duration to cover space rental. The stock owner also receives a fee that can automatically trigger payment to others who may have financed this via DeFi or TradFi. Attached to this could be automatic payment for taxes and regulatory requirements.

This arrangement can benefit all parties involved as it minimizes risk and maximizes profit potential. Plus, this model isn't geographically limited—the parties involved could be in different countries, making it a flexible solution for international trade.

Another potential application could be as a component of a sophisticated smart city, where all businesses are deeply interconnected. In such a scenario, the act of conducting transactions is not isolated; rather, it becomes a part of a larger, interconnected system. This means that when a transaction occurs, the information about this transaction is shared and disseminated to all relevant entities within the community. As a result, each transaction becomes a part of a closed-loop activity, where every action has a ripple effect throughout the community, reflecting the profoundly interrelated nature of businesses in a smart city. This then allows the smart city to work as a community supporting each other, following the core concept of Kula.Digital

Questions

These questions come from this that can't be covered in this work.

What will banking look like in the future?

What will the clearing house market become?

How will regulators handle this change and be able to police it?

What are the legal and tax implications when you no longer have the chain of movement to capture activity?

How do we create a true identity model that works at KYC/KYB/AML levels?

How do we protect privacy while still allowing regulated access?

How do we manage the perception of this due to the negative response to CBDCs?

How does this fit under current regulations and future changes coming into play?

Is this managed as an RWAT, deposit token, stablecoin, or a new form of the token?

Is this a commercial transaction as defined in the new Iowa Bill 2519?

Conclusion

Implementing an end-to-end transfer model for all parties significantly reduces the consumer burden, thereby creating cost savings and risk mitigation for all. This model fundamentally alters the traditional approach to managing money transfers, streamlining the process and eliminating unnecessary intermediaries.

Our initial estimate that managing money costs the world about 10% appears to be close to the mark. This figure represents the cumulative costs incurred across various sectors and processes, implying that the potential savings from transitioning to an end-to-end model could be substantial.

For this transformation to occur, we require a blockchain infrastructure that is designed with automatic splitting as an inherent function, called an atomic transaction, and not a coded function of a smart contract. This capability is crucial to enable the instant and direct distribution of transactional value to all involved parties with precise rollback functions on any failure before any funds are released. Additionally, this blockchain should run a permissions-based token model, providing a necessary layer of security and control over who can participate in the blockchain as a layer of protection.

Another feature is the ability to execute actions on the blockchain. This can be done directly on the chain or via computing nodes linked to intelligent wallets. These wallets can have contracts associated with them during fund transfers.

An existing blockchain that fulfils these conditions is the Hedera blockchain. Hedera is known for its fast, fair, and secure platform, which makes it an ideal candidate for implementing the end-to-end transfer model we're envisioning with native atomic one-to-many transactions that are native to the chain instead of having to be managed by a smart contract. Utilizing a blockchain like Hedera can move closer to a future where financial transactions are more efficient, transparent, and equitable for all parties involved.

Risks

However, such a transition will not be without opposition. The current system of fund transfers underpins many industries. A direct end-to-end model could significantly affect these industries, which have been built around and depend on the costs of moving funds. The challenges and resistance are likely to come from businesses that stand to lose from this transition, regulators and the fees they earn from this, and consumers who may be wary of the changes.

Industry disruption is not a new phenomenon. Similar upheavals in various sectors as new technologies and models challenge the status quo. The banking system, however, has remained somewhat immune to such disruptions. Until now, current technology has merely accelerated operations instead of causing disruption. However, significant changes are now on the horizon that could completely change the purpose of the bank, as potentially, we can become our own bank.

Banks have been navigating this evolving scenario, deploying fear, uncertainty, and doubt (FUD) strategies. They've allowed NeoBanks to emerge, acquiring them and employing other predatory models to maintain their dominance. Regulators have also been part of this process so as not to disrupt the status quo too far.

Such patterns have previously been observed in other sectors, such as telecommunications and media companies, as these industries underwent substantial transformations with the advent and growth of the Internet. These examples illustrate the potential scale and impact of the changes that the banking and finance sector could experience.

Finally

However, it's also important to note that these changes offer opportunities for innovation and improvement with a whole new protocol that can be executed. An end-to-end transfer model could lead to more transparent and efficient processes, greater consumer control over their funds, and the potential for new business models and services. Hence, while the transition might be challenging, its potential benefits make it worthwhile.

💰 And history has shown us that innovations in the monetary system have coincided with significant leaps in economic activity.